The global zinc market is expected to experience significant changes in the coming years, as various trends and factors impact its supply and demand dynamics. As we look ahead to 2024, several key developments are anticipated to affect the price and availability of zinc.

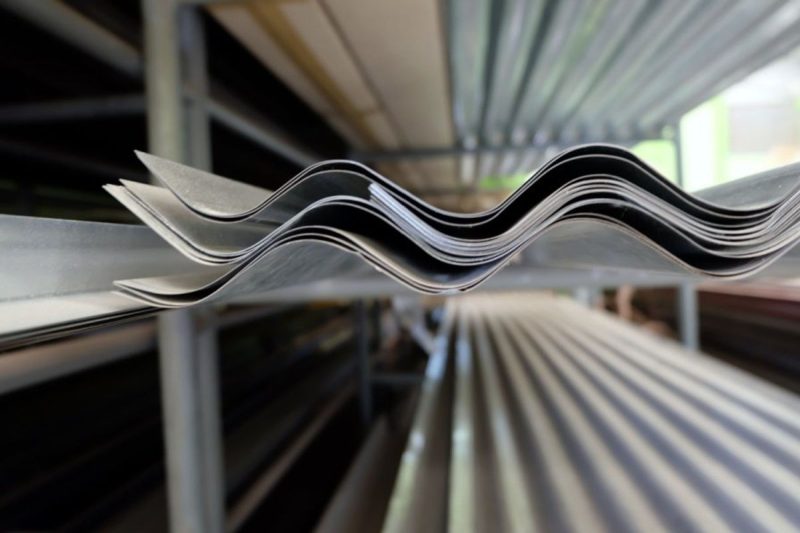

1. Growing demand for galvanized steel:

One of the primary drivers for zinc demand is the production of galvanized steel, which accounts for approximately half of the global zinc consumption. Galvanized steel is extensively used in construction, automotive, and infrastructure projects due to its corrosion resistance properties. The continued expansion of these sectors, particularly in emerging economies like China and India, is expected to fuel the demand for zinc. This rise in demand will likely have a positive impact on zinc prices.

2. Infrastructure development and urbanization:

As countries focus on infrastructure development and urbanization, the demand for zinc is expected to rise further. Zinc is used in various applications, including roofing, pipes, and electrical transmission lines – all of which are essential components of modern infrastructure. The massive infrastructure projects planned in regions like Asia and Africa will contribute significantly to the growth of zinc demand.

3. Transition to renewable energy sources:

Another factor that will influence zinc demand in the coming years is the shift towards renewable energy sources. Zinc-air batteries, which are used for energy storage in renewable systems, rely on zinc for their operation. With the increasing adoption of renewable energy technologies, such as wind and solar power, the demand for zinc as a key component in energy storage systems is expected to rise.

4. Recycling and sustainability initiatives:

Sustainability is a growing concern across various industries, including the zinc sector. Recycling programs and initiatives aimed at reducing the environmental impact of zinc mining and production are gaining traction. The sustainable management of zinc resources through improved recycling practices can help offset the demand for primary zinc and contribute to price stability.

5. Supply constraints and geopolitical factors:

The availability of zinc is also subject to supply constraints and geopolitical factors. Zinc mines and smelters can be impacted by regulatory changes, labor disputes, and geopolitical tensions, which can disrupt the supply chain and impact zinc prices. Political and economic developments in major zinc-producing countries, such as China, Peru, Australia, and the United States, are closely watched by market participants.

6. Technological advancements:

Technological advancements in the zinc mining and processing sectors can also play a role in shaping the market. Innovations that enhance extraction efficiencies, reduce energy consumption, and improve the overall sustainability of zinc production are being explored. These advancements can increase the supply of zinc and potentially alleviate price pressures.

In conclusion, the zinc market is expected to witness significant shifts in the next few years. Factors such as the demand for galvanized steel, infrastructure development, the transition to renewable energy sources, recycling initiatives, supply constraints, geopolitical factors, and technological advancements will all play a role in determining the price and availability of zinc. Stakeholders in the zinc industry need to closely monitor these trends to effectively respond to market dynamics and capitalize on emerging opportunities.