Silver Cross Buy Signals on the Dow (DIA) and Russell 2000 (IWM)

The Silver Cross buy signal is a popular technical indicator used by traders to identify potential changes in market trends. This signal occurs when a short-term moving average crosses above a long-term moving average, signaling a potential shift from bearish to bullish sentiment.

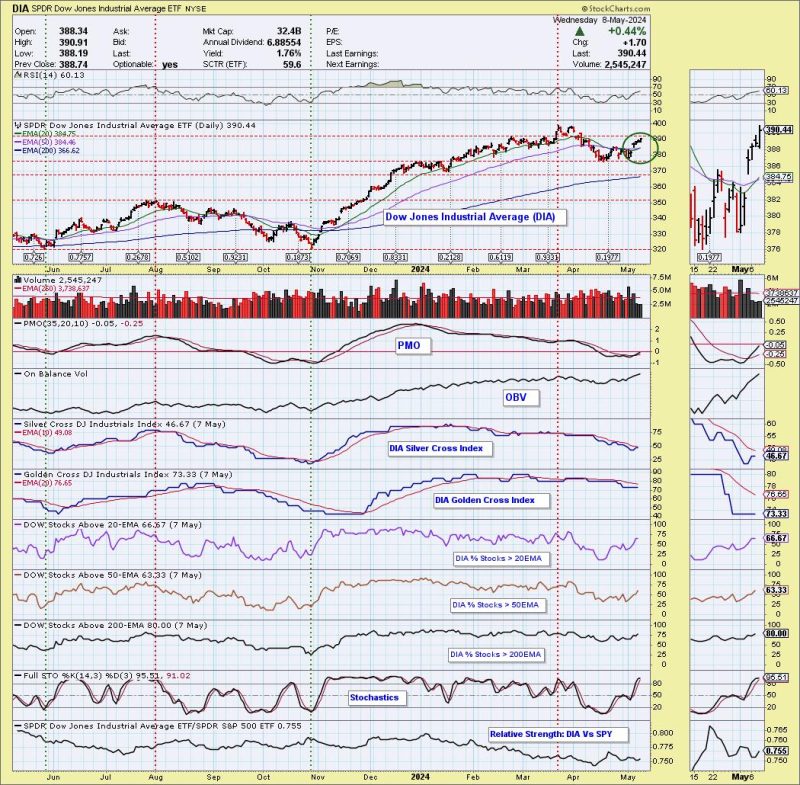

In recent trading sessions, both the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM) have exhibited Silver Cross buy signals, hinting at the possibility of upward momentum in the near future. These signals are indicative of growing investor confidence and optimism in the market outlook.

The Dow Jones Industrial Average, comprising 30 large-cap blue-chip stocks, is a key benchmark index that reflects the performance of the broader market. The recent Silver Cross buy signal on the DIA suggests that investors are becoming more bullish on the prospects for the index, anticipating potential gains in the coming days.

Similarly, the Russell 2000 index, which tracks the performance of small-cap stocks, also flashed a Silver Cross buy signal. This could indicate that investors are increasingly willing to take on more risk and bet on the potential for smaller companies to outperform in the current market environment.

While the Silver Cross buy signals on these indices are not guarantees of future performance, they can serve as valuable inputs for traders looking to make informed decisions about their investment strategies. By paying attention to these technical indicators and monitoring market trends, investors can better position themselves to capitalize on potential opportunities in the market.

In conclusion, the recent Silver Cross buy signals on the Dow (DIA) and Russell 2000 (IWM) suggest that a shift in sentiment may be underway, potentially paving the way for upward momentum in the near future. Investors should continue to monitor market developments and factor in both technical indicators and fundamental analysis when making investment decisions.