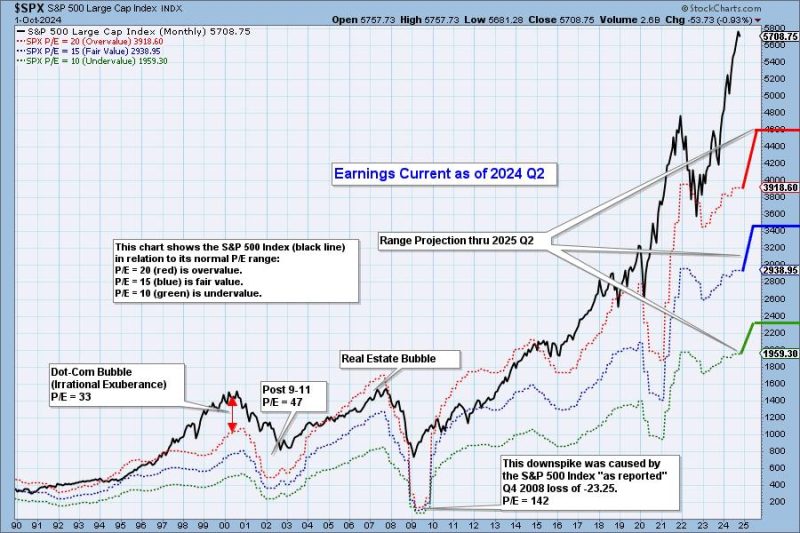

The stock market is a complex and ever-changing arena, influenced by a multitude of factors that can drive prices up or down in a matter of moments. However, one consistent trend that has emerged recently is the perception of overvaluation in the market. As the second quarter of 2024 comes to a close, many analysts and investors are taking a closer look at the current state of the market and questioning whether stock prices accurately reflect the true value of companies.

A key factor contributing to the skepticism surrounding market valuation is the recent flurry of earnings reports. While many companies have exceeded expectations and reported strong profits for the second quarter, there is a growing concern that these positive results are artificially inflating stock prices. Some analysts argue that the current high valuations are unsustainable and do not accurately reflect the underlying fundamentals of the companies in question.

One potential explanation for the disconnect between earnings and market valuations is the impact of external forces such as monetary policy and investor sentiment. The unprecedented levels of government stimulus injected into the economy in response to the COVID-19 pandemic have created a unique environment in which traditional valuation metrics may not fully apply. Additionally, the rise of retail investors and social media-driven trading trends have added a new layer of volatility to the market, further complicating the picture.

In light of these factors, some investors are proceeding with caution and adjusting their portfolios to account for the possibility of a market correction. Diversification, risk management strategies, and a focus on long-term investment goals are becoming increasingly important in a market that is perceived as overvalued by many. While the current environment may present challenges, it also offers opportunities for astute investors who are able to navigate the uncertainty and identify value in the midst of the chaos.

As the second quarter of 2024 draws to a close, the debate over market valuation is likely to intensify. While opinions may vary on the true extent of the overvaluation, one thing is certain – the stock market remains a dynamic and unpredictable entity that requires careful consideration and thoughtful analysis in order to navigate successfully.