The large-cap versus small-cap debate has long been a topic of interest among investors. Both categories of stocks have their own unique characteristics, advantages, and disadvantages. This article aims to provide a direct comparison between the two through the use of a Relative Rotation Graph (RRG), as demonstrated on Godzillanewz.com. The RRG helps visualize the relative strength and momentum of different stock market sectors over time.

Large-cap stocks are generally associated with well-established companies that have a market capitalization exceeding $10 billion. These companies are often leaders in their respective industries and have a proven track record of stability and growth. Due to their size, they tend to have a large market presence and access to significant resources. Examples of large-cap stocks include Apple, Microsoft, and Amazon.

On the other hand, small-cap stocks are typically represented by companies with a market capitalization between $300 million and $2 billion. They are relatively younger and less well-known compared to their large-cap counterparts. Small-cap companies have greater growth potential and can be more innovative and agile. However, they also carry greater risk due to their limited resources and dependence on a smaller customer base.

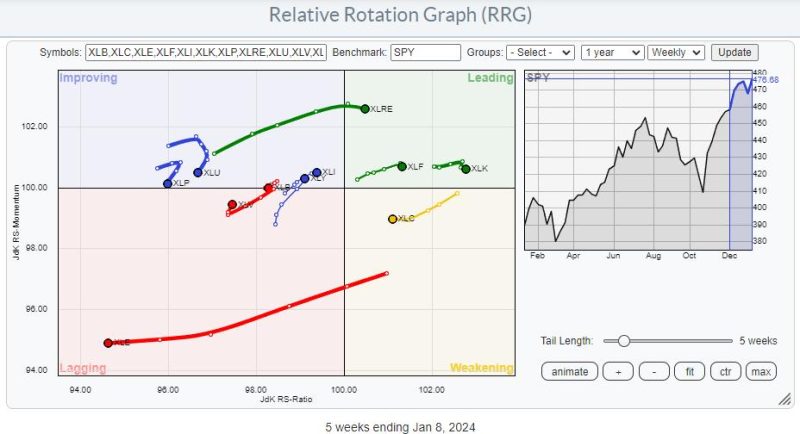

Now let’s explore how the RRG helps us compare the two categories. The RRG is a visual charting tool that displays the relative strength and momentum of different sectors or stocks. It plots the movement of stocks on a chart with four quadrants: Leading, Weakening, Lagging, and Improving.

Using the RRG, we can observe the performance of large-cap and small-cap stocks and determine which category is currently exhibiting greater relative strength and momentum. The RRG chart on Godzillanewz.com allows users to input various stock indices or sectors to create custom RRG charts and see the movement of large-cap and small-cap stocks in relation to each other.

By analyzing the RRG chart, investors can gain insights into the rotations and trends of large-cap and small-cap stocks. For instance, they can identify when small-cap stocks are outperforming large-cap stocks or vice versa. This information can help investors make more informed decisions on where they should allocate their investments.

It is important to note that investing in large-cap or small-cap stocks should be based on individual preferences, risk tolerance, and investment goals. Large-cap stocks can offer stability and potential dividends, but their growth potential may be limited compared to small-cap stocks. Small-cap stocks, on the other hand, can provide exciting opportunities for growth but carry a higher level of risk.

In conclusion, the Relative Rotation Graph (RRG) is a valuable tool for comparing the performance and momentum of large-cap and small-cap stocks. By analyzing the movements of these categories on the RRG chart provided on Godzillanewz.com, investors can gain valuable insights into which category is currently exhibiting greater relative strength. However, it is essential to consider personal investment goals and risk tolerance when deciding whether to invest in large-cap or small-cap stocks.