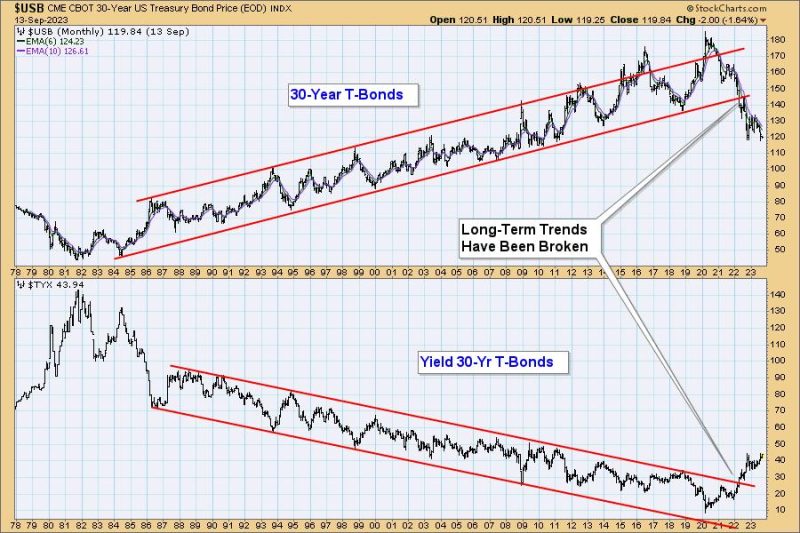

When it comes to investing in the stock market, we’ve heard the phrase time and again: Buy low, sell high. While this is true in the short term, it’s important to remember the long-term trend when it comes to bonds as well. The long-term trend of bond prices is downward, meaning that they tend to lose value over time.

Bond prices are influenced by inflation, and a bond’s yield is calculated by taking the coupon payments into account. As inflation rises, the purchasing power of money falls, meaning it takes more money to buy the same item. This decreased purchasing power causes bond investors to receive a lower return on their investment than they expected, resulting in bond prices falling.

While it’s true that bond prices are falling, there can be a benefit to holding onto bonds for a longer period of time. The longer a bond is held, the greater the probability that the holder will earn a higher return than anticipated from coupon payments. This is because over the long haul, the coupon payments are typically larger than those available in the short-term, often leading to higher returns over the life of the bond.

As bond prices continue to fall, it’s important to remember that investors must adjust their expectations regarding returns from bond investments. While the current sentiment may be to sell off bonds as prices decrease, it’s important to consider the long-term trend when it comes to bonds. Over the long haul, bonds can yield higher returns, and even be a lucrative investment. Just remember to buy them at the right price, and hold them for the long term.