As the global economy continues to navigate through uncertain times, investors are closely monitoring the shifts in the stock market. Recently, there has been a noticeable trend towards value stocks outperforming growth stocks, signaling a potential shift in market dynamics. While this may present opportunities for some investors, there are also downside risks that should be considered.

One downside risk for stocks as value takes the lead is the potential for increased market volatility. As the market adjusts to the changing preferences of investors, there may be increased uncertainty and fluctuations in stock prices. This volatility can make it challenging for investors to make informed decisions and may lead to short-term market inefficiencies.

Another downside risk is the impact of rising inflation on stock prices. Value stocks, which are typically more sensitive to changes in economic conditions, may be particularly vulnerable to inflationary pressures. As consumer prices rise, companies may face higher production costs and lower profit margins, which can weigh on stock prices.

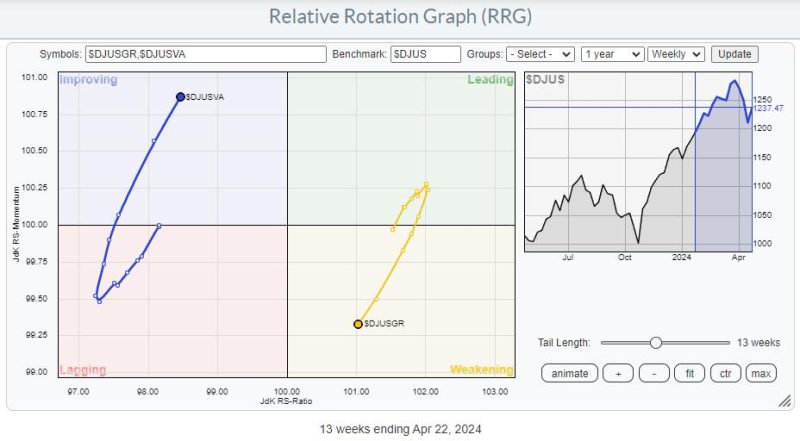

Furthermore, a shift towards value stocks may result in sector rotations within the market. Certain industries that have been favored by investors during periods of growth may see a decline in demand as value stocks gain traction. This sector rotation can lead to a reshuffling of investment portfolios and may result in some stocks underperforming relative to the broader market.

Additionally, geopolitical events and policy changes can introduce uncertainty into the market, impacting stock prices. As investors adjust to new regulations or changes in government policies, there may be a reevaluation of the intrinsic value of certain stocks. This uncertainty can create fluctuations in stock prices and increase risk for investors.

Moreover, the ongoing global supply chain disruptions and labor shortages pose a challenge for companies, affecting their revenue and profitability. Companies that rely heavily on overseas production or face supply chain constraints may struggle to meet demand, impacting their stock prices. These disruptions highlight the fragility of the current economic environment and underscore the risks associated with investing in stocks.

In conclusion, while the shift towards value stocks presents opportunities for investors, there are also downside risks that should be carefully considered. Market volatility, inflationary pressures, sector rotations, geopolitical events, and supply chain disruptions all contribute to the overall risk profile of investing in stocks. By staying informed and diversifying their portfolios, investors can better navigate these challenges and position themselves for long-term success in the ever-changing market landscape.